After having seen the NACE International (now AMPP) 2016 International Measures of Prevention, Application, and Economics of Corrosion Technologies (IMPACT) Study, the International Union of Painters and Allied Trades (IUPAT) reached out to AMPP in regard to conducting a similar country-specific study in Canada.

IUPAT partnered with the NACE Northern Area to become the two major sponsors on the project. The study was conducted over six months and was completed in April 2021. The key purpose was to foster coordination between government and industry to change the mindset about corrosion mitigation being the sole concern of materials and corrosion engineers and those that maintain corrodible assets.

“After the global study, there was a huge amount of interest on particular regions,” explains Monica Hernandez, country manager for the IMPACT Canada Study and CEO of Infinity Growth Corporation, Vancouver. “Canada has its own climate, and different industries, so there was an interest from industry in knowing how we were represented as a country. I think that was the first stepping stone and what motivated the subsequent steps.”

This initiative will help industry understand the financial and societal impacts of corrosion on various industry sectors across Canada. Four sectors were examined—energy, transportation, manufacturing, and mining. These sectors were chosen because of their large size based on gross domestic product (GDP), and the mining sector in particular was chosen, not only based on its size, but the fact that they were far behind in terms of their corrosion practices.

Information found from these industry sectors will aid in identifying opportunities for the public and private sectors to improve corrosion management across the lifecycle of their assets. The cost of corrosion on Canada’s bridges, buildings, pipelines, and all major infrastructure is enormous. These costs may seem invisible, but governments, private industry, and all Canadians are paying the price of industrial deterioration. In fact, the cost of corrosion in Canada is estimated to be $63.26 CAD ($51.9 billion U.S. dollars) annually, which represents nearly 3% of Canada’s GDP. It is estimated that 15 to 35% of this cost could be saved if all available corrosion mitigation techniques were utilized and applied. For Canada, this would equate to $7.8 billion to $18 billion.

“Technology helps us invent coatings, and nanotechnology, and new things—but if we don't invent anything new, if we don't learn anything, if we only use the resources we have right now, the learning we have right now, the people we have right now—we can reduce that cost 15 to 35%,” says Hernandez. “So why are we not doing it?”

The 2021 IMPACT Canada study also provides a means for government and industry to coordinate on best practices for corrosion management and planning in diverse industry and municipal sectors. For several decades, business leaders and assetowner organizations have considered the practice of corrosion prevention and control as the sole responsibility of materials and corrosion engineering experts, practitioners, and maintainers within their organizations. However, the risks associated with aging infrastructure are prevalent and costly, so now it is incumbent upon corporations to assess a broader array of financial risks by placing value on potential corrosion-related consequences and failures.

Business decisions should be optimized so that those who develop budgets consider financial gains that inevitably result from investing in corrosion control.

Although the study took place in Canada, it can be helpful for other countries as well. “Other countries will be able to take information from the study and say, ‘I wonder how we compare?’” says Elaine Bowman, past president of NACE International and member of the study team. “It’s already generated discussions with other countries to do very similar studies as well.” Another country can take the data from the report and get an idea about how they compare as far as spending, how different industries are performing, and how much work needs to be done and in what areas.

Corrosion Management Systems

A corrosion management system (CMS) is the documented set of processes and procedures required for planning, executing, and continually improving the ability of an organization to manage the threat of corrosion for existing and future assets and asset systems. To lower the cost of corrosion and increase safety, corporations in Canada must adopt a robust CMS. This process will require them to fundamentally change their corporate cultures to the extent that asset integrity becomes a core value as critical as safety management. Such a significant cultural change must flow from the top to the bottom levels of each business organization. Asset owners in Canada should also recognize that a strong CMS guarantees a greater return on investment.

“A big motivator was to increase the knowledge for regulators,” says Bowman. “Perhaps they would put into place that when you design a highway, or bridge, or the assets that the government is helping to pay for—that you were including corrosion management aspects of that in the planning.”

The study revealed the importance of changing cultural mindset to include corrosion management as part of an organization’s strategic planning. Doing so would increase return on investment (ROI) related to industrial assets, while also increasing protection of the public and environment.

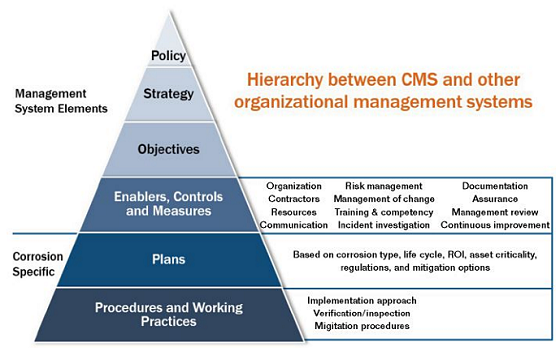

Adopting more robust corrosion management practices, including plans for addressing corrosion across the entire lifecycle of an asset, would help reduce the staggering cost of corrosion. Advancing corrosion knowledge and training to create a skilled workforce via Canada’s educational network and corrosion-focused training bodies, such as technical societies, is another way to strengthen efforts by companies seeking to implement a successful CMS framework. A comparison of CMS to other organizational management systems can be seen in Figure 1.

Key IMPACT Canada Study Findings

The AMPP study team examined nine management system domains to determine how Canada’s energy, manufacturing, mining, and transportation sectors implemented corrosion management practices across the asset lifecycle, during the phases of design, manufacturing and construction, operations and maintenance, and abandonment. The team also explored benchmarks on sustainability.

The energy, manufacturing, mining, and transportation participants excelled at integrating certain corrosion management processes, while showing the need to improve upon the policies, resources, organization, accountability, and communication components that can impact asset preservation and return on investment. The 2016 NACE IMPACT study showed that businesses in Canada that simply excel at managing corrosion at the design or manufacturing stages have significant room to improve compared to global participants.

The following sections will include details and additional key findings from each sector plus sustainability.

Canada’s Energy Sector

Within the continuous improvement domain, energy companies signal, by a large margin, that formal organizational management of change processes do exist.

In the CMP integration area, numerous energy businesses attest to the fact that their corrosion management processes include risk management. In the domain of resources, however, Canada’s energy sector is challenged across the entire lifecycle of asset preservation. At the policy level, corrosion management is not emphasized across the lifecycle, but it is seriously considered during the asset design strategy phase and the operations and maintenance stages of asset preservation. This result stems from the fact that leadership does not view corrosion management as an enterprise-wide pursuit.

Canada’s Manufacturing Sector

This sector exhibited three areas of strength related to the commitment to corrosion management: accountability, continuous improvement, and stakeholder integration. But in the domain of policy, Canadian manufacturers must improve by developing a corrosion management strategy across the entire lifecycle of asset preservation, including at the design, manufacturing and construction, operations and maintenance, and abandonment phases.

Manufacturers would benefit from better communication of their corrosion management processes and better alignment of their corrosion management processes and tools with their health, safety, and risk management disciplines.

Canada’s Mining Sector

In the realm of CMP integration, mining sector participants included risk management as one of their corrosion management processes, a significant strength. Participants also reported that corrosion control practices are designed into their systems and solutions, another strength.

Whereas the domain of organization posed a significant challenge across the entire lifecycle of asset preservation among mining industry participants, the study team found that corrosion professionals did interact with colleagues in the design organization, within operations and maintenance groups, and among asset abandonment experts. Two other challenge areas for mining sector participants fell within the domains of accountability and resources across the entire lifecycle of asset preservation.

Canada’s Transportation Sector

Throughout the lifecycle of asset preservation, researchers noted that within the domain of CMP integration, survey participants feel that their corrosion management processes are well-communicated. Participants also included risk management as one of their corrosion management processes, a notable strength. As regards performance measures, participants excelled in that their corrosion management systems resulted in the lowest corrosion cost over the intended life of the asset. These companies excelled at monitoring and reporting corrosion management performance.

Sustainability

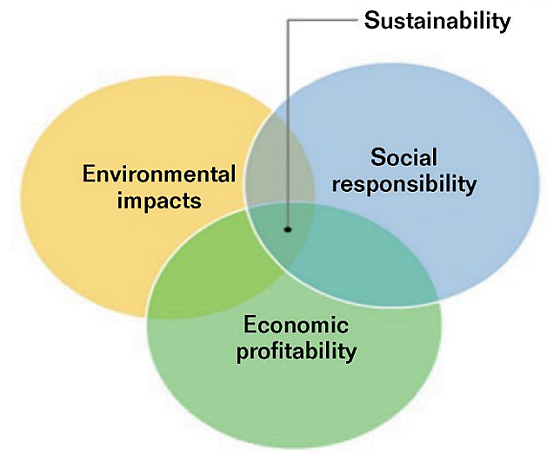

Material sustainability refers to the way materials are sourced, processed, and manufactured into products, and then maintained through the product lifecycle and redirected at their end of life.

Canada’s business culture reflects a commitment to sustainable business practices at the design and manufacturing and construction stages of the asset lifecycle.

However, compared to countries who participated in the 2016 NACE IMPACT Study, Canada falls behind in its ability to integrate corrosion management planning across all four stages of an asset’s lifecycle.

Close to 70% of study participants considered material sustainability during the operations and maintenance phase of asset preservation, a noteworthy strength. More than 60% of those surveyed reported that they promoted sustainability during the design phase of an asset’s lifecycle. However, fewer than 48% of Canadian companies cite sustainability as a corrosion management priority. Canadian asset owners suggested that their corrosion management processes would greatly benefit from more robust sustainability policies and strategies at all organizational levels and throughout an asset’s lifecycle.

Extending the lifecycle of a corrodible asset through best practices in corrosion management ensures organizations are operating at optimum sustainability (Figure 2).

Embracing Enterprise-Wide Corrosion Management—Cultural Mindset

Those who worked on the study say they hope there is a cultural change within companies and industries. Recognizing that Canada’s government, industry, and academic realms have strong corrosion prevention regulations, standards, and training in place, the IMPACT Canada report reviews the merits of Canada’s pipeline regulations, the strength of current standards and where they can be improved, and the rich array of education and training programs supported by academia, government, and industry.

To improve upon its current strengths in these areas, all asset-owner companies must shift their corporate cultures toward successful corrosion management from top to bottom, establishing it as a norm analogous to today’s safety management culture.

Such a shift necessitates a cultural change that must flow from top to bottom. To bring about change, businesses must translate their corrosion practices into the language of their broader organizations. The report also explores useful management and financial tools such as IMPACT PLUS, which can help companies build a corrosion management system and integrate it within their existing systems.

“[The IMPACT Canada report] validated that there needs to be a cultural mindset—a change within companies,” says Bowman. “Perhaps you have to spend more upfront, but over the lifecycle of the asset, your ROI is going to be better. There needs to be a change in the mindset that, even though it might cost more upfront, you’re going to recoup that.”

Corrosion mitigation is not relegated to just the concern of corrosion engineers and those who maintain corrodible assets but is the responsibility for all within an organization who design, build, operate, or maintain an asset. There must be a change in the existing cultural mindset, so corrosion management is included as part of an organization’s strategic planning as a method to increase ROI related to industrial assets while also increasing protection of the public and environment.

Bowman says the IMPACT Canada report has already spurred interest from other countries in conducting their own similar country-specific report. In fact, AMPP is currently in discussions with Australia and some of the Latin American countries.

The 2021 IMPACT Canada study is fully accessible online. It can be found on the AMPP web site (ampp.org) and the IUPAT web site (iupat.org). For questions pertaining to the IMPACT Canada Study, contact Monica Hernandez, email: monica@infinitygrowth.ca.